Understanding Diversification

Diversification in investing spreads risk by allocating investments across various assets. When investments are spread out, a downturn in one market won’t heavily impact the entire portfolio. Asset classes include stocks, bonds, real estate, and commodities. Mixing these helps reduce exposure to any single economic sector or geographical area.

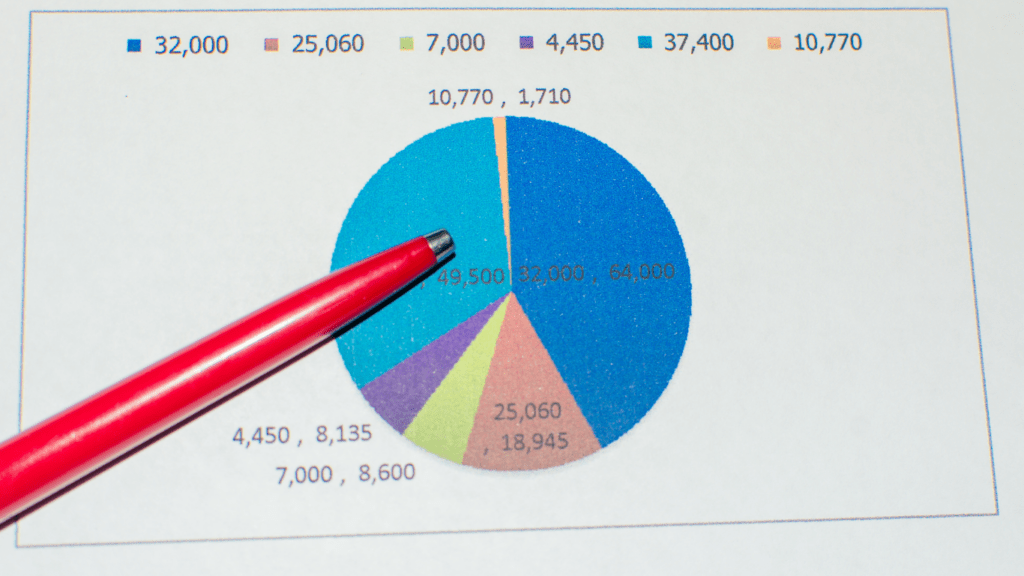

Asset allocation is key in diversification. Different asset types have varying risk levels and returns. For example, stocks offer high returns but come with high volatility, while bonds provide steady, lower returns. By combining them, I balance potential returns against acceptable risk levels, adjusting according to my financial goals and risk tolerance.

Geographic diversification involves investing in global markets to protect against regional economic downturns. By including international stocks and bonds, I tap into emerging markets and benefit from global growth. Currency fluctuations are another consideration in this strategy, potentially impacting returns positively or negatively.

Sector diversification spreads investments across different industries. The energy, technology, and healthcare sectors, for example, often perform differently under the same economic conditions. By investing across multiple sectors, I minimize the risk of overexposure to any single industry’s downturn.

Overall, diversification helps create a resilient investment strategy. Through careful asset allocation and strategic choice of sectors and geographies, I’ve aimed to boost returns while mitigating risks.

Benefits of Diversification

Diversification offers a range of advantages to investors aiming to optimize their portfolio’s performance. With careful allocation across various assets, investors can strengthen their investment strategies.

Risk Reduction

By spreading investments across different asset classes and sectors, I mitigate the impact of adverse movements in any single market. When one asset underperforms, others may offset the losses, ensuring my portfolio remains robust. According to Vanguard, diversified portfolios can reduce risk by up to 30%.

Enhanced Returns

Diversification also positions me to capture gains from multiple sources. Balancing high-risk, high-reward assets with stable ones increases the chances of achieving consistent returns over time. An analysis by BlackRock suggests that global diversification has historically provided an average annual return increase of 1%-2%.

Portfolio Stability

I secure long-term portfolio stability by investing in diverse assets. This stability comes from reduced volatility, as loss in one part of my portfolio is often mitigated by gains elsewhere. Studies indicate that diversified portfolios experience 20%-30% less volatility than non-diversified ones, maintaining steady growth.

Types of Diversification

Diversification plays a crucial role in enhancing investment returns by spreading risk across various avenues. There are several ways to diversify an investment portfolio effectively.

Asset Class Diversification

Asset class diversification involves spreading investments across different categories like:

- stocks

- bonds

- real estate

- commodities

By allocating funds to multiple asset classes, I can reduce the impact of downturns in any one area. For instance, while stocks offer growth potential, bonds provide steady income, offsetting volatility.

Geographical Diversification

- Geographical diversification entails investing in international markets beyond my home country.

- This approach helps mitigate risks associated with economic downturns specific to one region.

- By investing globally, I can benefit from growth opportunities in emerging markets while cushioning the impact of regional recessions.

Sector Diversification

Sector diversification spreads investments across multiple industries, such as:

- technology

- healthcare

- consumer goods

This strategy minimizes the risk of portfolio exposure to sector-specific declines. By balancing investments across sectors, I ensure that my portfolio can withstand underperformance in any single industry, maintaining stability and enhancing returns.

Strategies for Effective Diversification

Diversification offers investors a way to enhance returns while reducing risk. Implementing strategies effectively can significantly impact the investment portfolio’s success.

Spreading Investments Across Asset Classes

Investing in a variety of asset classes forms the foundation of diversification. I allocate my resources across stocks, bonds, real estate, and commodities. Stocks provide potential for high growth, bonds offer stability, real estate presents tangible property value, and commodities hedge against inflation. This approach spreads exposure and reduces the overall risk of my portfolio.

Balancing Risk and Reward

Determining the right balance between risk and reward is crucial for successful diversification. I analyze each investment’s risk level and expected returns. High-risk assets may offer greater returns but increase volatility. By counterbalancing these with more stable investments, I achieve a mix that aligns with my risk tolerance and investment goals.

Regular Portfolio Rebalancing

Staying aligned with my investment strategy requires regular portfolio rebalancing. Market fluctuations can alter asset values, disturbing the desired asset mix. I monitor my portfolio and make necessary adjustments to ensure it remains diversified, aligning with my long-term objectives. This maintenance protects my portfolio from unintended concentrations and keeps risk under control.

Caitlin Grove brought her expertise in communication and content strategy to Funds Fortune Roll, crafting engaging and educational articles that resonate with a diverse audience. Her ability to break down sophisticated financial concepts into relatable and actionable advice has helped the platform connect with both novice and seasoned investors. Caitlin's dedication to delivering high-quality content has been instrumental in the success of Funds Fortune Roll.

Caitlin Grove brought her expertise in communication and content strategy to Funds Fortune Roll, crafting engaging and educational articles that resonate with a diverse audience. Her ability to break down sophisticated financial concepts into relatable and actionable advice has helped the platform connect with both novice and seasoned investors. Caitlin's dedication to delivering high-quality content has been instrumental in the success of Funds Fortune Roll.