Understanding Market Momentum

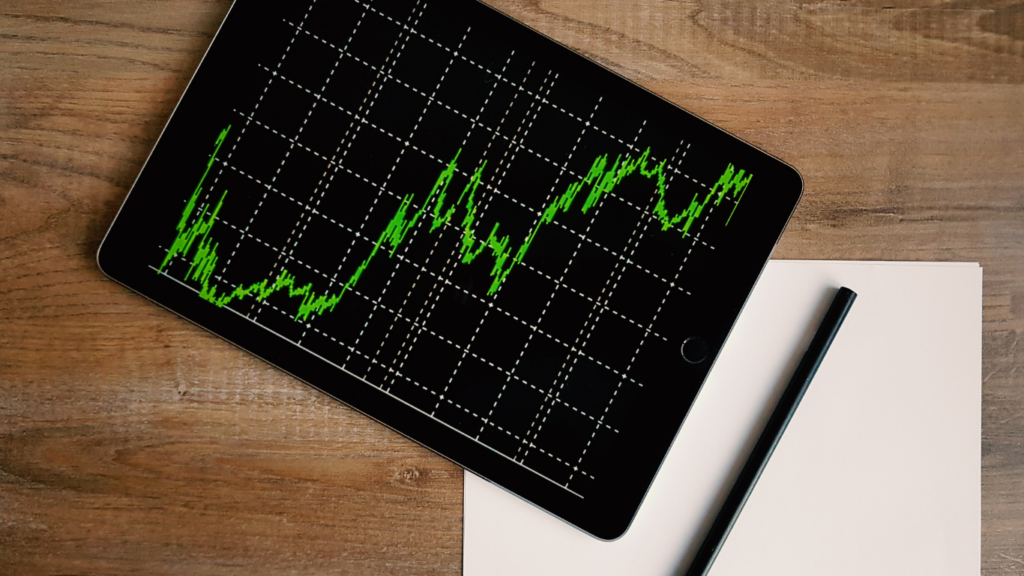

Market momentum plays a pivotal role in investment strategies. It identifies trends to gauge future movement and helps in aligning actions with market shifts.

What Does Bullish Mean?

Bullish denotes an optimistic market view. When I say a market is bullish, I mean prices are rising or expected to rise. Investors exhibit confidence, and there’s often an upward trend in stock values. During bullish phases, I notice increased buying activity, driving demand and pushing prices higher. Certain economic indicators like GDP growth and low unemployment often accompany bullish markets.

Defining Bearish Trends

Bearish trends signal price decline and investor pessimism. I observe bearish sentiment when the market experiences downward pressure. Investors anticipate falling prices, leading to selling activity. This results in reduced stock values. Economic downturns, negative news, or poor earnings reports typically trigger bearish markets. Understanding these trends helps me prepare for potential risks associated with investment decisions.

Key Indicators of Market Momentum

Identifying key indicators of market momentum is vital for understanding potential market shifts. These indicators offer insights into bullish or bearish trends and guide investment decisions.

Moving Averages

I value moving averages for their ability to smooth out price data and reveal the direction of trends. A simple moving average (SMA) calculates the average price over a specific period, like 50 or 200 days, and is frequently used. When a shorter-term SMA crosses above a longer-term SMA, it often signals a bullish trend, while crossing below suggests a bearish trend.

The Role of Volume

Volume measures the number of shares traded over a given period and serves as a confirmation tool for price movements. High trading volume often accompanies significant market moves, indicating strong momentum in either direction. If prices rise on increasing volume, it’s a bullish signal, while falling prices on high volume suggest bearish pressure.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator assessing if a stock is overbought or oversold. I find RSI values crucial; readings above 70 typically indicate overbought conditions, possibly preceding a price correction, while values below 30 suggest oversold conditions, hinting at a potential upward reversal. This tool helps me identify entry and exit points in fluctuating markets.

Analyzing Bullish Trends

Bull markets, marked by rising prices and investor optimism, offer unique opportunities. Understanding these trends aids in strategic decision-making by helping identify timely actions.

Characteristics of a Bull Market

A bull market features several key indicators:

- Increasing Prices: Stock prices steadily climb, signaling a broad market uptrend.

- Rising Investor Confidence: Pervasive optimism drives investment activities and enhances market participation.

- Strong Economic Indicators: Economic growth is evident through rising GDP, low unemployment, and increased corporate profits.

- Higher Trading Volume: Substantial trade volumes affirm investor engagement and validate the upward trajectory.

Strategies for Bullish Markets

Capitalizing on bullish conditions requires distinct strategies:

- Buy and Hold: Purchasing promising stocks and holding them to benefit from long-term price increases.

- Sector Rotation: Shifting investments into rapidly advancing sectors, such as finance or technology, during economic expansion.

- Trend Following: Leveraging technical analysis tools like moving averages to confirm trends and make informed entry decisions.

- Diversification: Allocating assets across various industries to mitigate risk while enjoying widespread gains.

By focusing on these characteristics and employing winning strategies, investors can maximize gains during bullish periods and enhance their portfolio outcomes.

Identifying Bearish Patterns

Recognizing bearish patterns empowers investors to mitigate loss risks and adjust their strategies effectively. These patterns, when identified early, guide decision-making in volatile markets.

Signs of a Bear Market

Certain indicators signal the onset of a bear market. A prolonged decline in stock prices, often exceeding 20%, is a key sign. Declining economic indicators, like reduced consumer spending and slowed GDP growth, reinforce this view. Increased market volatility highlights investor uncertainty during these times. Sentiment indices, reflecting pessimism and fear, become more pronounced as well.

Navigating Through Bearish Trends

Successfully navigating bearish trends requires strategic adjustments. I focus on capital preservation by reallocating assets to defensive sectors such as utilities and consumer staples. Exploring opportunities in value stocks, which often trade at a lower price compared to their intrinsic value, offers potential gains despite a bearish outlook. Hedging strategies, including options contracts, protect portfolios by offsetting potential losses. Lastly, staying informed and flexible ensures adaptability as market conditions evolve.

Tools and Resources for Tracking Momentum

Consistent tracking of market momentum enriches investment strategies. By leveraging specialized tools and resources, I enhance my ability to interpret bullish and bearish trends effectively.

Popular Analytical Tools

Analytical tools are essential in dissecting market movements. I use Moving Averages to smooth price data—key in identifying trend direction. The Relative Strength Index (RSI) assists in pinpointing overbought or oversold conditions. Additionally, MACD (Moving Average Convergence Divergence) helps in understanding momentum changes through signal lines. Bollinger Bands reveal volatility shifts by showing price levels relative to past trades.

Utilizing Market Reports

Market reports give comprehensive insights into economic indicators and sector performance, vital for momentum analysis. I rely on reports from trusted sources like Bloomberg and MarketWatch for up-to-date data. Earnings reports show company performance trends which impact stock movement. Economic forecasts in reports offer clues on future market paths, assisting in momentum interpretation.

Caitlin Grove brought her expertise in communication and content strategy to Funds Fortune Roll, crafting engaging and educational articles that resonate with a diverse audience. Her ability to break down sophisticated financial concepts into relatable and actionable advice has helped the platform connect with both novice and seasoned investors. Caitlin's dedication to delivering high-quality content has been instrumental in the success of Funds Fortune Roll.

Caitlin Grove brought her expertise in communication and content strategy to Funds Fortune Roll, crafting engaging and educational articles that resonate with a diverse audience. Her ability to break down sophisticated financial concepts into relatable and actionable advice has helped the platform connect with both novice and seasoned investors. Caitlin's dedication to delivering high-quality content has been instrumental in the success of Funds Fortune Roll.