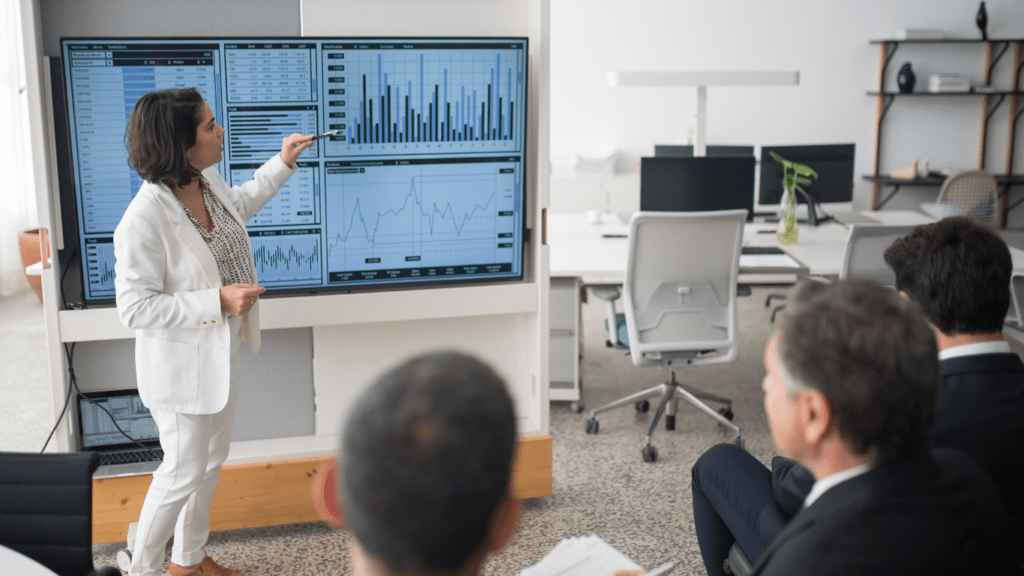

Overview of the Current Stock Market

Key indices show strong momentum with the S&P 500, NASDAQ, and Dow Jones experiencing significant gains. This surge is largely driven by upbeat economic forecasts and robust corporate earnings reports. The S&P 500 has risen by about 3% this month, while the NASDAQ has appreciated over 5%. Global developments, such as easing inflation pressures, have boosted investor sentiment. Technology and healthcare sectors lead gains, reflecting resilience and innovation.

Emerging markets also contribute to the positive outlook. Many countries benefit from improved trade relations and stabilizing currencies. Analysts point to China’s manufacturing recovery and Brazil’s commodity export growth as influential factors. Currency fluctuations create variability in international investments but offer diversification opportunities.

Economic reports provide additional optimism. Recent data indicate upward trends in consumer spending and job creation. The labor market’s strength fuels confidence in sustained economic growth. Retail and hospitality industries show promising recovery signs, underscoring consumer confidence and increased activity.

Investors focus on central bank policies. Interest rate decisions and monetary policy adjustments influence stock valuations. The Federal Reserve’s cautious stance reassures markets, with hints of steady rates supporting equities. European Central Bank actions also impact currency value, affecting international stock dynamics.

Key Indices Showing Growth

Major stock indices are reflecting an optimistic outlook for global markets. I highlight the notable performances of the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite as examples of this growth.

Dow Jones Industrial Average

The Dow Jones Industrial Average, one of the oldest and most watched indices, has shown growth. It recently climbed 2% this month, driven by strong performances in industrial and consumer sectors. Companies like Boeing and Disney contributed significantly to this rise. Investors recognize the index’s stability and use it as a bellwether for broader market trends.

S&P 500

The S&P 500 index, covering 500 of the largest companies, rose by approximately 3%. Key contributions came from technology and healthcare stocks, with giants like Apple and Johnson & Johnson leading the upward trend. Its performance showcases investor confidence in robust corporate earnings amid improving economic conditions.

Nasdaq Composite

Unlike the others, the Nasdaq Composite focuses heavily on technology and biotech sectors. It appreciated over 5% this month, outperforming other indices. Major players like Tesla and Amazon helped drive this surge. I consider the Nasdaq’s performance as a sign of strength in sectors that continue to push innovation and market disruption.

Factors Driving the Surge

Growing optimism in global markets stems from several decisive factors. Key economic indicators and robust corporate earnings reports play significant roles in this resurgence.

Economic Indicators

- Economic indicators show positive trends across multiple sectors.

- Notable is the rise in consumer spending, signaling increased confidence among consumers.

- Job creation rates have also elevated, with recent data revealing an addition of 180,000 jobs in the past month.

- Manufacturing output and services growth continue to contribute to the market’s buoyancy, confirming economic recovery.

Corporate Earnings Reports

Corporate earnings have surpassed expectations this quarter, influencing the bullish sentiment. Tech giants like:

- Apple

- Amazon

reported earnings that exceeded projections by over 10%, pushing their stock prices higher. Within the healthcare sector, Johnson & Johnson’s strong performance further boosts investor confidence. As these companies remain resilient and innovative, their results are pivotal in maintaining the upward trajectory of key indices.

Impact on Global Markets

Key indices soaring in the US have influenced global markets, with European and Asian investors sharing optimism. This global surge showcases a response to economic recovery signs and positive corporate earnings.

European Market Reactions

European markets have experienced a boost, evident in the FTSE 100 and DAX indices. The FTSE 100 has risen by 2% as energy and banking sectors, including BP and Barclays, show strength. The DAX has appreciated nearly 3%, supported by robust performances from Siemens and Daimler. European Central Bank policies further aid market stability, with steady interest rates attracting investment.

Asian Market Reactions

Asian markets, particularly in China and Japan, are witnessing upward trends. The Shanghai Composite index has advanced 1.5%, driven by improving trade conditions and tech sector growth, with companies like Alibaba leading the way. Japan’s Nikkei 225 has gained over 2%, fueled by advancements in export-driven industries like Toyota and Sony. Positive consumer spending in the region enhances this optimistic outlook, boosting investor confidence.

Keith Tipton played a crucial role in shaping Funds Fortune Roll into a go-to platform for financial insights. With his extensive background in market analysis, Keith contributed by developing tools and resources that empower users to understand economic trends and make informed investment decisions. His attention to detail and commitment to clarity ensure that complex financial topics are accessible to everyone, making him an integral part of the team.

Keith Tipton played a crucial role in shaping Funds Fortune Roll into a go-to platform for financial insights. With his extensive background in market analysis, Keith contributed by developing tools and resources that empower users to understand economic trends and make informed investment decisions. His attention to detail and commitment to clarity ensure that complex financial topics are accessible to everyone, making him an integral part of the team.